Use AI to revolutionize banks' risk management and decision-making

Join our challenge to revolutionize banks' risk management! We are seeking innovative solutions that integrate Large Language Models with traditional quantitative analytics to predict financial risks with greater accuracy. Unleash your creativity and redefine banking risk assessment!

Who can participate?

Start-ups, (technology) companies, researchers, labs, newly founded tech teams and all other AI innovators

#AIRiskPrediction #FinancialAnalytics #AIinBanking

✅ Challenge completed 🏁 Winner 51nodes & AssetFloow🏆 Rewards Funded co-creation, strategic partnerships & long-term integration🌎 Scope Global

❓Questions Feel free to join our Q&A Calls

👥 Looking for a team? Join our Team Matching Channel

Problem statement

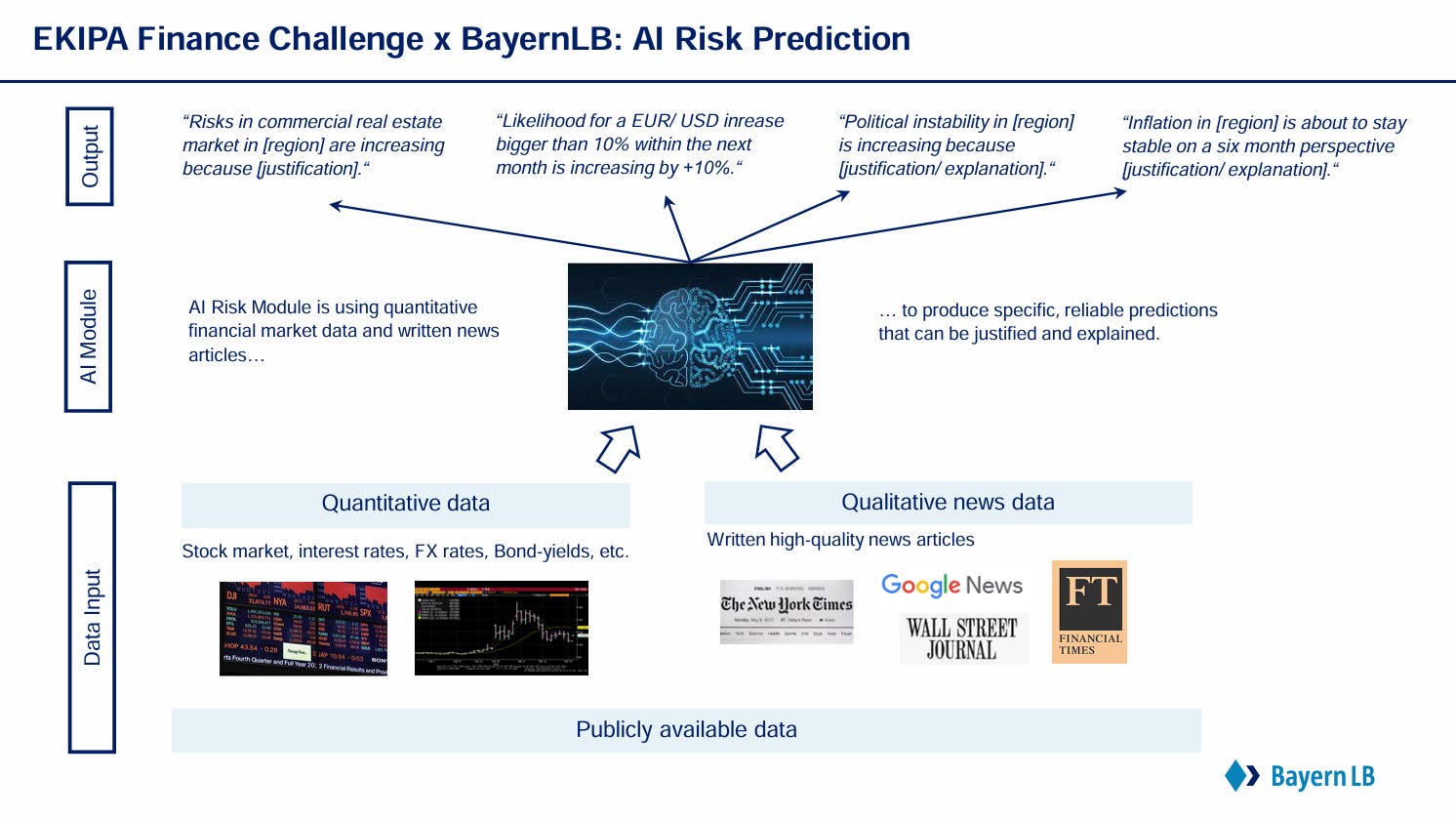

Monitoring, analyzing, and evaluating quantitative financial market data (e.g., interest or FX rates, stock markets) with traditional statistical tools has ever since been a classic job of a bank’s risk management department.

However, it's no secret that valuable, unstructured data, such as information from news articles or press releases, has been underutilized in risk prediction. Now is the time to address this oversight and fully harness its potential.

Your task

The challenge is to design a cutting-edge AI tool, which continuously monitors and assesses the financial markets as well as the news outlets.

- By combining quantitative data with textual information, the tool should give high-quality predictions about risks and future developments in various markets, segments, geographies or for public listed companies.

The idea is that combining classic quantitative financial data with information extracted from news articles, predictions about future risk events can be taken to the next level. This technology isn't just about data processing – it's about foresight. In that regard, Large Language Models (LLMs) offer unpreceded possibilities to analyze and evaluate textual information (e.g., news articles) in a structured and automated way.

Click here to download the visual in full size.

Are you ready to harness the power of LLMs and revolutionize risk management in banks? We're looking for innovators who can use LLMs not just to analyze data but to predict future events.

For more details about the Key Guidelines & Specifications click on the tab "Submission".

© 2018- 2026 ekipa GmbH. All rights reserved.